Silver’s Brutal Retreat

With historic losses on the table, here is the roadmap for a potential recovery.

The silver market in January 2026 has entered a state of pure paradox. On one hand, peer-reviewed industrial data suggests we are staring down the barrel of a “resource time bomb”. On the other hand, Silver just recently record a historical one day drawdown and practically entered bear market territory.

This leaves a lot of questions left, such as what are actionable insights to follow depending on the particalur market exposure to silver. Is the actual structure broken and what does China say to all of this?

Lets first take a look at this historical breakdown.

Diagram 1: Silver 1 year chart noting a 35% peak to trough drawdown.

We can note from this that it was definitely an ugly day, one of historical proportions. These types of moves are more akin to a breaking of a structure that happens at the end of a bull cycle. The nature of these moves is violent especially in silver which is often seen as the speculative metal, to have an exposure to when gold is in favour again which happens every few years.

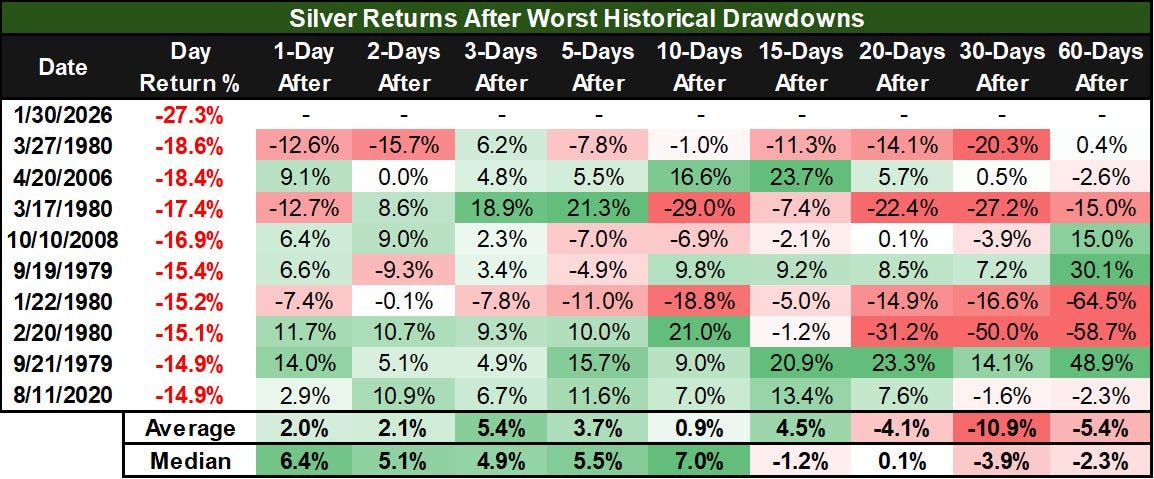

Diagram 2: Silver Returns are worse after a hirostical drawdown

The data reveals a clear dead cat bounce trend in the immediate aftermath of a crash. Historically, silver shows positive median returns for the first 10 days, suggesting that short-term relief rallies are common. For instance, the median return 10 days after a major drawdown is +7.0%, though individual results vary wildly, such as the +21.3% gain in March 1980 versus the -18.8% further drop in January 1980.

BUT. What are the reasons for the breakdown to begin within?

Reasons for Silvers Breakdown

If the fundamentals are so bullish, why was smart money leaving prior to the move? In December 2025, market sentiment shifted into high gear as retail investors, spurred by “last chance” narratives, began piling into silver ETFs at record rates.

Diagram 3: Smart money out, Dumb money in

As of late January 2026, silver has already seen a 50% rise in just one month, crossing the psychological 125 USD mark. But while retail investors chase the 150 USD targets set by banks like Citi, the technicals were showing a classic “parabolic bubble.” The consolidation phases have become shorter and the price spikes steeper a textbook sign of an impending “exhaustion gap.”

This leads us to believe that there are three significant reasons:

Dumb money entering as seen above fueling a speculative mania, directly supported by golds strong fundamentals

Market fundamentals, while remaining strong the market has already started to priced in a part of the silver bull thesis

Overleveraged move, once the selling started rolling in the stop-losses by retail traders and institutionals got hit leading to margin calls. Thus, simply a vicious cycle.

It can be said that everybody expected silver sooner or later to correct, I was personally surprised by the intensity of it, given the nature of silver and the speculation it was only a matter of time.

So what is the fundamental silver case?

Silvers Fundamental Case

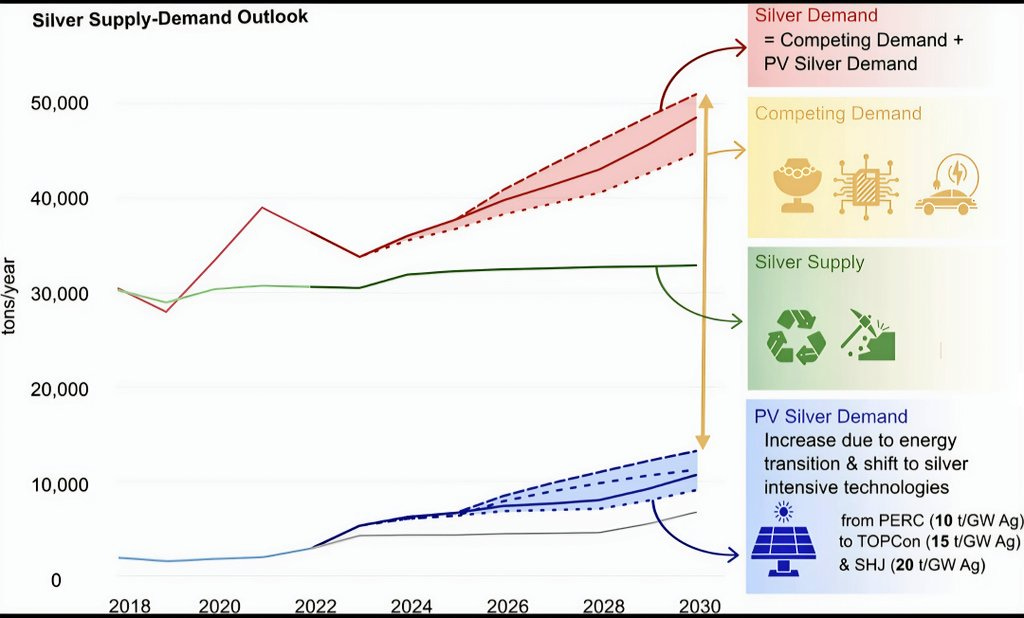

We can note three key parts of silvers fundamental case that will continue to impress longterm. Firstly, according to a landmark study published in Resources, Conservation and Recycling (January 2026), the silver market is moving toward a catastrophic industrial collision. By 2030, silver production is projected to cover only 60% of global demand, leaving a staggering 40% annual deficit.

Diagram 4: Silver Supply-Demand Outlook

High-efficiency solar modules (like TOPCon and HJT) require up to three times more silver per unit than older designs. With global green-energy mandates forcing a 400% expansion in solar capacity by 2030, the math simply doesn’t work. Because 70% of silver is a byproduct of other mining, supply cannot scale to meet this demand, no matter how high the price goes.

The above article assumes that silver substitution and decreasing the silver contents will be hard. However, as an investor and market speculator its always best to take a more conservative approach.

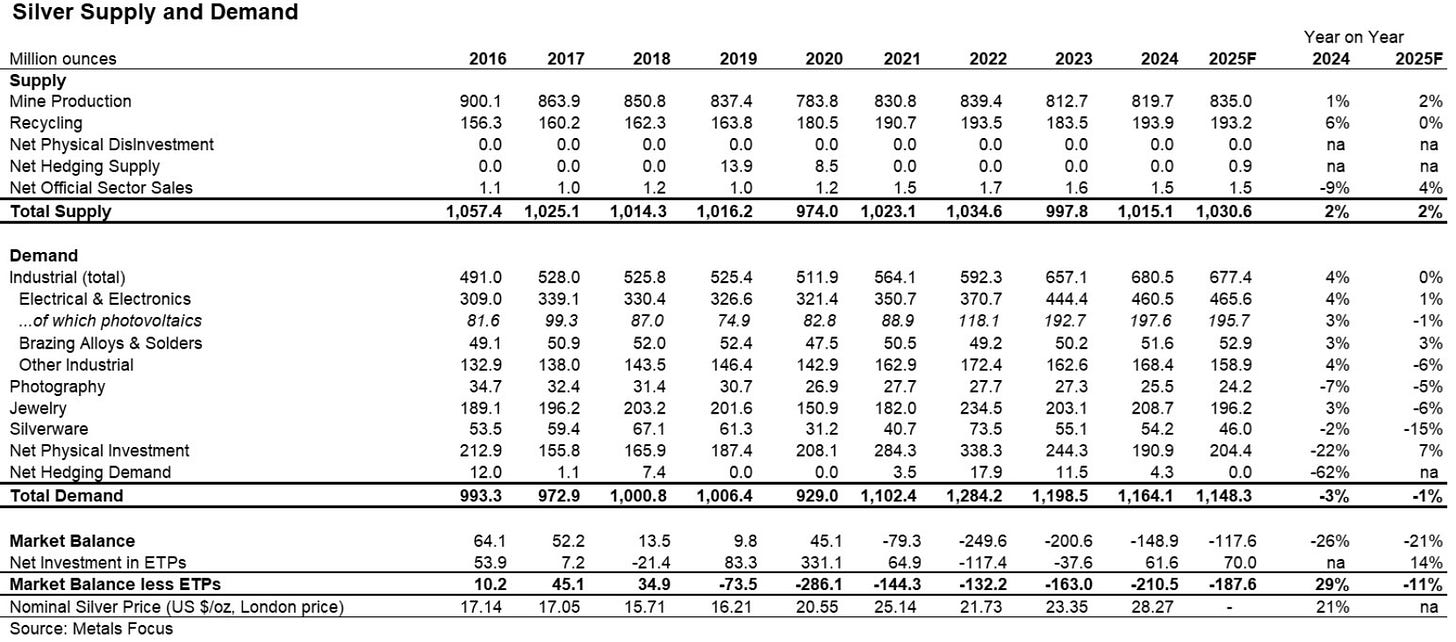

Secondly, we can note that Mine production has declined by 7% since 2016 and is expected to remain flat or grow modestly, as silver is primarily mined as a byproduct, making it difficult to increase output rapidly. The global silver market is in its fifth or sixth consecutive year of deficit, with a cumulative shortfall of roughly 800 million ounces since 2021.

Diagram 5: Silver Supply-Demand currently

Demand is at record levels due to next-gen solar (photovoltaics) and AI technologies, leading to a “great divorce” where industrial buyers are draining physical vaults and ignoring the fluctuating paper prices.

Lastly we have the China Factor/Geopolitics in china’s move to secure its own domestic supply for its massive PV (photovoltaic) industry has contributed to a global physical squeeze. The implementation of the new licensing regime on January 1, 2026, has changed the global precious metals landscape by shifting from a volume-based quota system to a qualification-driven “whitelist”. By authorizing only 44 specific firms largely state-owned giants like Jiangxi Copper and Yunnan Tin to move silver across its borders.

Beijing has effectively eliminated hundreds of independent private traders. This consolidation allows the Chinese government to monitor and adjust the flow of refined silver with surgical precision, ensuring that the nation’s domestic strategic reserves remain insulated from the supply deficits currently hitting Western markets. However, this has led to a severe increase in the premium between the shanghai spot and the western spot as seen below.

Diagram 6: China Premiums

The timing of this “silver purge” has proven particularly devastating for the global photovoltaic industry, which is currently transitioning to N-type TOPCon cells. These next-generation solar panels require up to 50% more silver paste than previous models to maintain their efficiency.

With silver prices recently breaching the historic 120 USD per ounce mark, the metal has transformed from a trace material into a dominant cost driver, now accounting for approximately 30% of a solar module’s total manufacturing cost.

This has forced major Chinese manufacturers like Longi to accelerate the mass production of silver-free or copper-based cells, though many Western competitors lack the immediate capital to follow suit. However, this makes the point that trenching as a concern is real.

Overall, the result is a structural reordering of the silver market that analysts expect to persist through the 2026–2027 licensing cycle. As global silver demand continues to outstrip supply for the sixth consecutive year, the “whitelisting” process serves as a powerful reminder that critical minerals are increasingly being used as tools of state.

Lastly, we can of course talk about the geopolitics and the gold factor. However, this would severly extend the length of this article so I will write a specific article covering that.

My Strategy for 2026

This backdrop of tightening supply and record-breaking highs, my current strategy views silver within a broad consolidation range for the year, oscillating between 75 and 125 USD, with a reinforced hard floor at 50 USD.

This outlook yields three core actionable insights:

Short-Term: Keep track of dumb money and smart money entering, this should reverse again and we will see another big impulse(probably getting within 10% to aths). Trimming is the best to do the closer we get to the 120 USD top.

Medium-Term: There is a broad consolidation move to happen and scaling is of importance, trim near aths and starting buying some small amounts near the 75 USD price, and especially if that 50 USD floor gets hit. Preferably in silver miners with a nice margin of safety(judging by future production).

Long-Term: Keep watching the supply and demand data, as well as keeping track how the gold trade progresses as gold is more likely to be in a long secular bull market that will have to take a breather for a few months. Silver is speculative so the longterm approach is to always to play it cyclical and take into consideration important price points.

By maintaining a cyclical mindset and utilizing these specific price ranges, one can navigate the noise of retail sentiment while positioning for the long-term tailwinds of the green transition and the broader secular bull market in precious metals. In addition, remind yourself that cash is a position as well and worth holding to be opportunistic in these volatile markets!

One thing I do want to say is never let yourself get into the doomerism this field is actively pushing. Its only a cyclical doom and be smart to trim, or increase positioning when price asks for it.

Cheers!

Lukas from Pixel Research

Disclaimer

This is not financial advice as Pixel Research content is not meant to be a substitute for financial advice. Since we don’t offer financial advice, the material provided shouldn’t be interpreted as tailored investment advice. It is crucial to carry out in-depth research and, if required, speak with a licensed financial expert before making any financial decisions.

Thorough article about Silver, helps me better understand the situation. Thanks!

Great Article Thanks for sharing your thoughts.